Tax Relief

Your 1098-T

In previous years, your 1098-T included a figure in Box 2 that represented the qualified tuition and related expenses (QTRE) we billed to your student account for the calendar (tax) year. Due to a change to institutional reporting requirements under federal law, beginning with tax year 2018, we will report in Box 1 the amount of QTRE you paid during the year.

Depending on your income (or your family’s income, if you are a dependent), whether you were considered full or half-time enrolled, and the amount of your qualified educational expenses for the year, you may be eligible for a federal education tax credit. (You can find detailed information about claiming education tax credits in IRS Publication 970, page 9.)

The dollar amounts reported on your Form 1098-T may assist you in completing IRS Form 8863 – the form used for calculating the education tax credits that a taxpayer may claim as part of your tax return.

Should you as a 1098T recipient view that your records indicate that you paid a different amount than what was reported in Box 1, please refer to IRS Publication 970 (2017) page 2 which states, “When figuring an education credit, use only the amounts you paid and are deemed to have paid during the tax year for qualified educational expenses. However, the amounts on Form 1098-T (Box 1), might be different than the amount paid and are deemed to have paid”. Hence, the amount reported in Box 1 on the 1098-T is not necessarily equal to the amount paid to the university for qualified tuition and related expenses. It is up to the taxpayer to determine by using your records what in fact, you did pay in qualified expenses.

Capital University is unable to provide you with individual tax advice, but should you have questions, you should seek the counsel of an informed tax preparer or adviser.

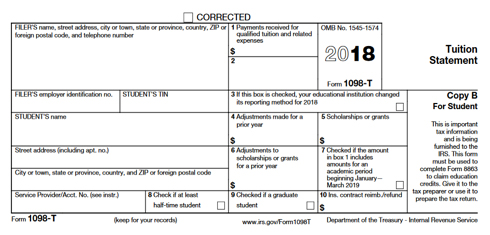

Below is a blank sample of the 2018 Form 1098-T for your general reference. For more information about Form 1098-T, visit https://www.irs.gov/pub/irs-pdf/f1098t.pdf.

Form 1098-T FAQ

Because of a change in statute, beginning in January 2019, colleges and universities will no longer be able to report amounts billed for qualified tuition and related expenses (QTRE) in Box 2 of their 2018 Forms 1098-T. Instead, institutions will only be able to report payments of QTRE in Box 1. As seen in the Instructions for Students on the 1098-T, Box 1 shows the total payments received by an eligible educational institution in 2018 from any source for qualified tuition and related expenses less any reimbursements or refunds made during 2018 that relate to those payments received during 2018.

Receipt of a Form 1098-T indicates that you were enrolled in at least one course at Capital University during the past calendar year. It does not mean that you are eligible for a tuition and fees deduction, Hope Credit or Lifetime Learning Credit. According to federal tax regulations, determination of payments made for qualified tuition and related expenses is the responsibility of the tax payer.

Information on the 1098-T is reported for each calendar year, January 1 through December 31. The IRS requires all taxpayers and universities to report this information on this calendar year basis which is different than the academic year (August – May). The 1098-T summarizes payments from any source (actual payments, loans, 529’s, scholarships and grants) for qualified tuition and fees in Box 1 and only Scholarships and Grants in Box 5 that have been posted to a student’s account during the calendar year. All payments from any source made in a calendar year will be reported on the calendar year's 1098T regardless of what semester for which the payment is made. Reporting activity on a calendar year basis creates a timing difference on the student's 1098-T. This difference is caused by the spring semester activity being posted in different calendar years; the tuition is posted in December, approximately one month prior to the beginning of the term, and the associated scholarships and grants are posted in January of the following year, as required by Federal regulations. The IRS requires institutions to report on form 1098-T in this manner.

If you were enrolled in at least one course at Capital University during the past calendar year, you will have a 1098-T mailed to you by ECSI or you can view your 1098-T on-line at the Heartland/ECSI website. To access your 1098-T statement from the Heartland/ECSI website, you will need to know:

- First and Last Name (student’s)

- Social Security Number (student’s)

- Zip Code that appears on the 1098-T form (student’s permanent mailing address on file with Capital University)

How to access your 1098-T statement from the Heartland ECSI website:

- Click on https://heartland.ecsi.net/

- Click on For Students and Borrowers (left side)

- Click on Tax Documents (middle of bottom row)

If you are a current Capital University student, you can also access your 1098-T in WebAdvisor under the Financial Information Tab.

- Box 1. Payments Received for Qualified Tuition and Related Expenses: This box includes all payments made from any source for qualifying tuition and related expenses less any reimbursements or refunds made during the calendar year that relates to those payments in the same calendar year.

- Box 2. This box will be blank. No longer populated per the IRS regulations. This went into effect for the 2018 Tax Year.

- Box 3. Checkbox for Change of Reporting Method: This box will only be checked on the 2018 1098-T due to the required reporting method change mandated by the IRS. Due to this requirement, Capital University changed the reporting method (from Box 2, amounts billed to Box 1, payments received from any source).

- Box 4. Adjustments Mode for a Prior Year: This box is used to report changes in qualified charges posted to your account previously reported in prior years.

- Box 5. Scholarships or Grants. This box reports the amount of scholarships or grants posted to your account applicable to the calendar year.

- Box 6. Adjustments to Scholarships or Grants for a Prior Year: This box is used to report reductions in scholarships or grants previously reported in prior years.

- Box 7. Checkbox for Amounts for an Academic Period Beginning in January through March of the Following Calendar Year: This box will be checked if the amount in Box 1 includes an amounts for an academic period beginning January – March 2019. See Pub 970 for how to report these amounts.

- Box 8. Check if at Least Half-Time Student: This box will be checked if the student was at least a half-time student during any academic period during the calendar year.

- Box 9. Check if a Graduate Student: This box will be checked if the student was a graduate student; if the student was enrolled in a program or programs leading to a graduate –level degree, graduate level certificate, or other recognized graduate level educational credential.

- Box 10. Insurance Contract Reimbursement or Refunds: This box will be blank.